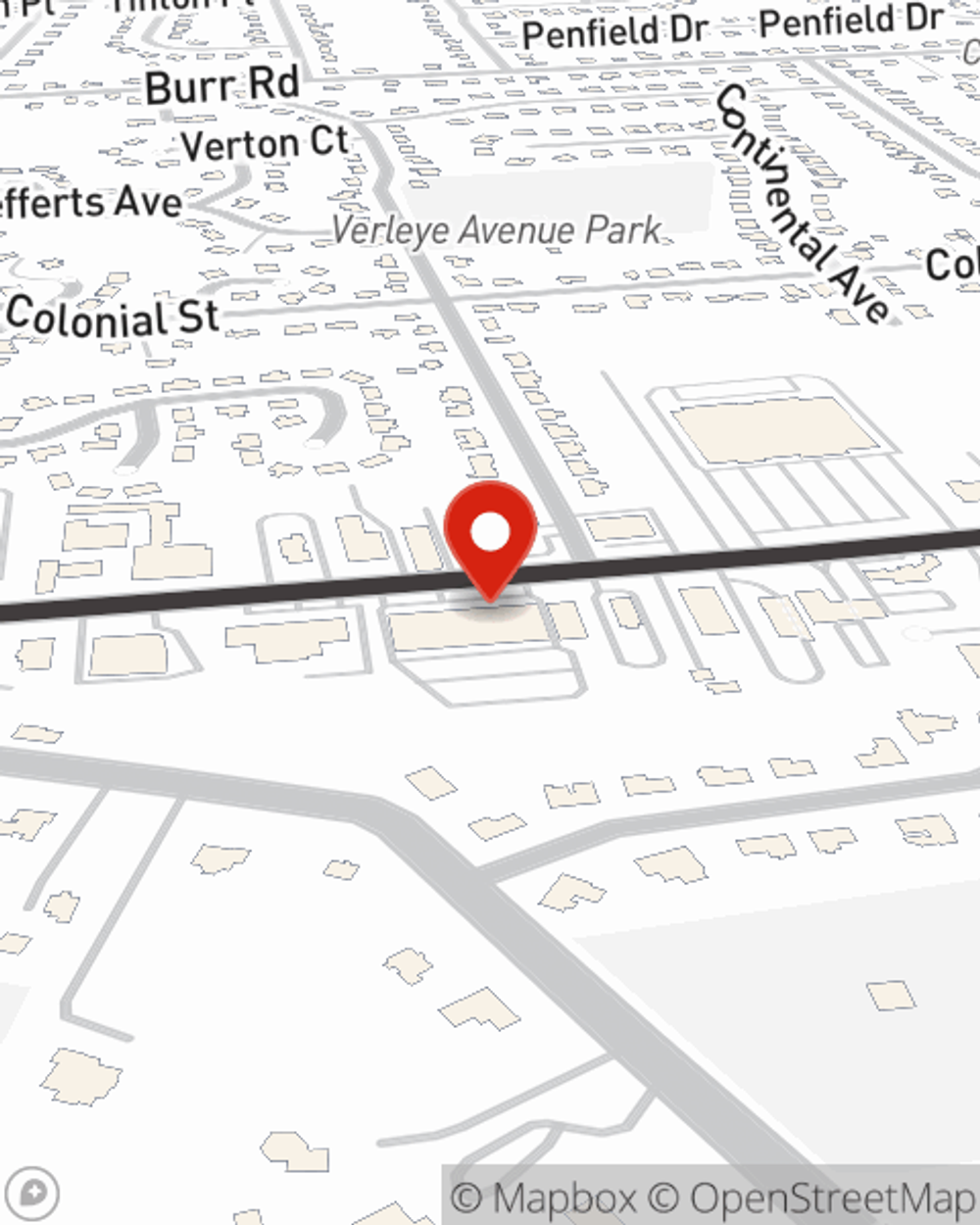

Business Insurance in and around E Northport

Get your E Northport business covered, right here!

Cover all the bases for your small business

- Huntington

- Dix Hills

- Central Islip

- Melville

- Elwood

- Smithtown

- Brentwood

- Greenlawn

- Hauppauge

- Deer Park

- Nassau

- Suffolk

- Bay Shore

- Ronkonkoma

- Farmingdale

- Medford

- Hicksville

- Queens

- Brooklyn

- Syosset

- Centereach

- Levittown

- Woodbury

- Garden City

Your Search For Excellent Small Business Insurance Ends Now.

Small business owners like you have a lot on your plate. From financial whiz to customer service rep, you do everything you can each day to make your business a success. Are you an acupuncturist, a physician or a real estate agent? Do you own a dental lab, a toy store or a dance school? Whatever you do, State Farm may have small business insurance to cover it.

Get your E Northport business covered, right here!

Cover all the bases for your small business

Customizable Coverage For Your Business

The passion you have to contribute to your community is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Gerald Cawley. With an agent like Gerald Cawley, your coverage can include great options, such as commercial liability umbrella policies, commercial auto and worker’s compensation.

Let's chat about business! Call Gerald Cawley today to learn why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Gerald Cawley

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.